FAAD Network Investor Meet In Mumbai 📢We’re excited to share that our recent FAAD Network Investor Meet in Mumbai was a huge success! We had the opportunity to showcase “3 incredible investment opportunities” and invited “50+ investors” to join us. We’re also thrilled to welcome our Regional Partner, Kavi Shahani, to the FAAD Network family! Kavi brings a wealth of experience and expertise to our team and we’re confident that he will be a valuable asset to both our investors and startups. And that’s not all – we’re proud to announce that we’ve officially launched our physical operations in Mumbai! This expansion is a significant milestone for us and we can’t wait to continue growing our presence in the region. Stay tuned for more updates and opportunities to connect with the FAAD Network community! Karan Verma Dr.Dinesh Singh Sanjay Agrawal Harshika Paliwal Shivani Khare Vraj Mehta Shubham Nandwani Vatsal Lunawat Aditya Arora Neha Mourya Source: https://www.linkedin.com/posts/faad-in_faadnetworkinvestormeet-mumbaiedition-faad-activity-7059047531325927425-cQ31/?utm_source=share&utm_medium=member_desktop

Sportstech Startup Game Theory Bags Funding From Nithin Kamath, Rohan Bopanna

Sportstech Startup Game Theory Bags Funding From Nithin Kamath, Rohan Bopanna Game Theory raised $2 Mn in its pre-Series A funding round from Nithin Kamath’s Rainmatter, Rohan Bopanna, WEH Ventures, Prequate Advisory, and angel investors The sportstech startup said it will use the fresh funding for technology development, to build skill-based matchmaking, establish coaching products, and expand the reach of smart sporting facilities Founded in 2018, Game Theory is creating an ecosystem through a user-friendly app, facilitating the seamless discovery of compatible players and enjoyable gaming experiences Sportstech startup Game Theory has raised $2 Mn in its pre-Series A funding round from Nithin Kamath’s Rainmatter, Rohan Bopanna, WEH Ventures, Prequate Advisory, and angel investors such as Balakrishna Adiga. Source: https://inc42.com/buzz/game-theory-bags-funding-from-nithin-kamath-rohan-bopanna-to-provide-sports-technology/

EV infra startup Bolt.Earth raises $20 Mn

EV infra startup Bolt.Earth raises $20 Mn EV infrastructure and software company Bolt.Earth has raised $20 million from Union Square Ventures, Prime Venture Partners and ITIGO Funds, among others. Union Square and Prime Venture Partners had already backed the Bengaluru-based startup during its Series A round of $4 million in September 2021. The company then rebranded itself from Revos to Bolt.Earth. The company said it will use the fresh capital infusion for charging network expansion, product enhancement, and operating system development and international expansion. Bolt.Earth offers charging solutions for individuals, businesses, real estate companies, fleet operators, and the government. The firm caters to a wide spectrum of charging needs, with options ranging from slow to fast charging, featuring power outputs from 3.3 kW to 240 kW. The company’s low-code integration platform helps OEMs and EV dealers to upgrade their vehicles. Bolt.Earth claims to have deployed more than 30,000 EV charging points within its charging network. The firm is now looking to ramp up its charging network and expand its business in Asia, Europe, South America, and Latin America. Bold.Earth remained in the pre-revenue stage during the fiscal ending March 2021. In FY22, the company recorded Rs 78.5 lakh revenue from operations along with a loss of Rs 22.35 crore. The company has not disclosed FY23 numbers yet. The fund inflow in electric vehicle startups picked up in the second half of 2023 after an initial drop down and this can be gauged from the funding trend when compared to the previous years. Data compiled by TheKredible shows that EV saw nearly 40 deals worth $631 million in funding during the first nine months of 2023 or till September this year. This is on par with previous years’ investments. In 2022 and 2021, the investments in EV-focused startups stood at $796 million and $570 million respectively. Source: https://entrackr.com/2023/10/ev-infra-startup-bolt-earth-raises-20-mn/

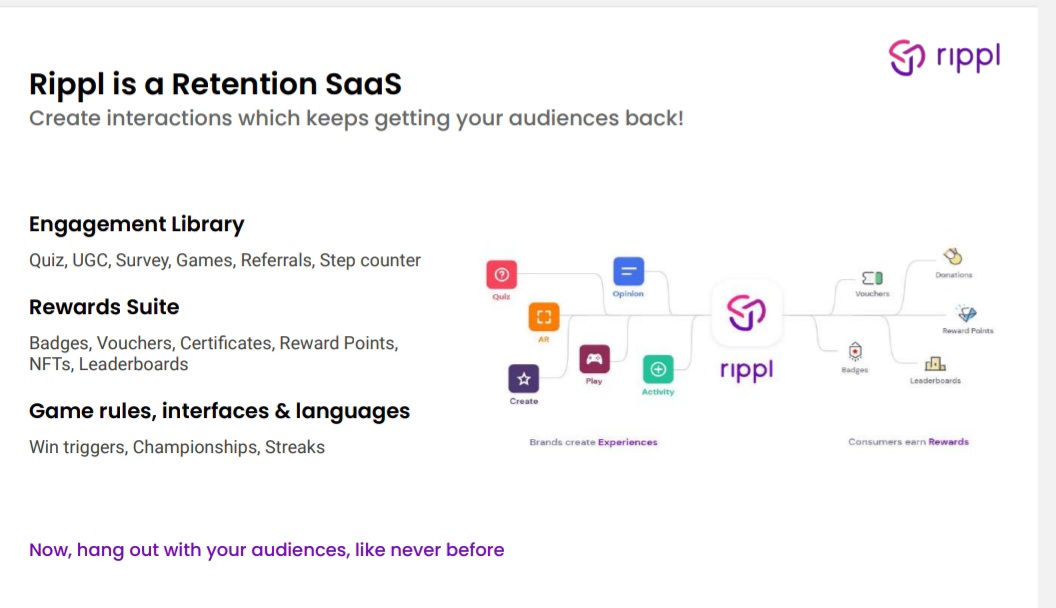

Try Using Gamification To Increase Customer Retention And Engagement.

Try Using Gamification To Increase Customer Retention And Engagement. Gamification is the process of incorporating game mechanics and elements into non-gaming contexts, such as a customer loyalty program or an e-commerce website. By doing so, it can help to improve customer engagement and retention in several ways: Increases motivation: Gamification provides customers with clear goals and incentives, such as rewards or achievements, which can motivate them to engage with a brand and continue using its products or services. Enhances customer experience: By making the experience of using a product or service more fun and enjoyable, gamification can increase customer satisfaction and loyalty. Provides immediate feedback: Gamification often provides immediate feedback on customer actions, such as completing a task or reaching a milestone, which can increase motivation and engagement. Builds community: Gamification can create a sense of community and encourage social interaction among customers, which can help to build loyalty and increase retention. Encourages repeat behavior: By rewarding customers for repeat behavior, such as making multiple purchases or referring friends, gamification can encourage customers to continue engaging with a brand over time.

RattanIndia Enterprises Acquires Revolt Motors

RattanIndia Enterprises Acquires Revolt Motors By Sujata Sangwan January 15, 2023, Updated on : Sat Jan 14 2023 22:51:27 GMT-0800 Following the acquisition, Revolt will be a wholly-owned subsidiary of RattanIndia Enterprises RattanIndia plans to significantly scale up Revolt’s growth Revolt Motors claims that its EV bikes have completed more than 20 Cr kms on Indian roads, and run on 3.24kWh lithium-ion batteries with 0% fuel residue RattanIndia Enterprises, a flagship company of RattanIndia Group, on Saturday announced that it has completed 100% acquisition of EV manufacturer Revolt Motors. Following the acquisition, Revolt will be a wholly-owned subsidiary of RattanIndia Enterprises and the latter plans to significantly scale up Revolt’s growth. Set up in 2017 by Micromax founder Rahul Sharma, Revolt Motors builds sustainable mobility vehicles–RV 400 and RV 300. It has a manufacturing facility in Manesar, Haryana. Revolt shared that it has expanded its footprint with 30 dealerships spread across the country. “The country needs environmentally sustainable mobility solutions and Revolt will surely be a leader in this transformation. We are very excited and fully geared up to make Revolt the largest EV motorcycle company in the country,” said Anjali Rattan, business chairperson, RattanIndia Enterprises Ltd. Explaining the mechanism of electric vehicles, Revolt Motors said that its AI-enabled EV bikes capture millions of data points every second over-the-air to enhance the driving experience. Revolt claims that its EV bikes have completed more than 20 Cr kms on Indian roads, and run on 3.24kWh lithium-ion batteries with 0% fuel residue. Its EV bikes give a top speed of 85 km per hour and can cover a distance of 150 kms on a single charge of four hours, said the startup. In 2021, Revolt bagged INR 150 Cr from RattanIndia Enterprises for an exchange of 43% stake in the startup. In India, it faces competition from the likes of Ultraviolette, Tork, Oben and Odysse, among others. As per a Mordor Intelligence report, the country’s electric vehicle market was pegged at $1,434 Bn in 2021. The industry is projected to grow at a CAGR of 47.09% to become $15,397 Bn space by 2027. It is important to note that the EV sector is one of the growing sectors of India currently. Basking on the growth rides, we have seen multiple funding deals happening in this segment. Yulu securing $82 Mn, Exponent Energy raising $13 Mn and Ather Energy bagging $128 Mn are some of the fundraising activities that occurred in the EV sector in the previous year. Recently, Entuple E-Mobility secured $3 Mn from Blue Ashva Capital and Capital A.

Mumbai Oncocare Centre gets $10M Series A funding from Tata Capital Healthcare Fund

Mumbai Oncocare Centre gets $10M Series A funding from Tata Capital Healthcare Fund By Sujata Sangwan January 15, 2023, Updated on : Sat Jan 14 2023 22:51:27 GMT-0800 MOC plans to utilise the newly infused capital to expand across India in the next 18 months. Mumbai Oncocare Centre (MOC) raised $10 million from Tata Capital Healthcare Fund (TCHF) to expand across India in the next 18 months. “The philosophy and mission of MOC—to provide high quality care at affordable price points—aligned with our objective of financing such scalable and profitable business models,” said Vamesh Chovatia, Partner at TCHF. TCHF runs a chain of cancer daycare centres and has raised around $200 million across two funds—TCHF I (2012) and TCHF II (2022). Across both the funds, TCHF has invested in 12 companies and has made five exits thus far. Founded in 2018 by four medical oncologists Dr Ashish Joshi, Dr Vashishth Maniar, Dr Pritam Kalaskar, and Dr Kshitij Joshi, MOC is operational at 16 locations across 10 cities of Maharashtra and Madhya Pradesh. “It is our privilege to join hands with Tata Capital, which is part of the Tata Group, which has earned and retained a reputation of being the most ethical industrial and business enterprise in India and globally,” said Manish Jobanputra, COO of MOC. According to the company, every year approximately 15 lakh people get diagnosed with cancer in India, and at any given time, there are additional 25-30 lakh cancer patients who are undergoing treatment. A large number of these patients need chemotherapy and immunotherapy, and the majority need to consult a medical oncologist during their treatment journey. MOC said it addresses this unmet need with community daycare centres that are fully compliant hospitals where these patients can get personalised care. MOC claims it puts high emphasis on clinical research, technology, and tumour boards where the collective wisdom of its oncologists ensures that the care given is always evidence-based.

A startup so good that sharks had to pitch their expertise to founders

A startup so good that sharks had to pitch their expertise to founders By Sujata Sangwan January 15, 2023, Updated on : Sat Jan 14 2023 22:51:27 GMT-0800 Paradyes claims to be India’s first semi-permanent hair colour brand that offers hair colours that last for 8-10 washes. Peyush Bansal called it a business that can create a category. Paradyes founders received many lucrative offers, but accepted a lower offer to bring the right sharks into their company – Vineeta Singh and Aman Gupta. Few products pitched on Shark Tank Season 2 courted as much attention from the sharks as Paradyes — India’s first semi-permanent hair colour brand. nspired by her own experiments with hair colouring, 26-year-old Yushika Jolly launched Paradyes in March 2021 with her husband, Siddharth Raghuvanshi. Based out of Ahmedabad, Paradyes aims to break myths surrounding hair colour, and go beyond the limited options (primarily browns and reds) available in the market. ““There are several myths about the damage that colouring might cause to your hair. We are here to inform our customers and audience about how they can experiment and style their hair without damaging them! Our products are Ammonia-free, Paraben-free, PPD-free, and damage-free,” states the company website.

Funding and acquisitions in Indian startups this week

Funding and acquisitions in Indian startups this week [09-14 Jan] Shashank PathakJanuary 14, 2023Weekly Funding Report Paradyes claims to be India’s first semi-permanent hair colour brand that offers hair colours that last for 8-10 washes. Peyush Bansal called it a business that can create a category. Paradyes founders received many lucrative offers, but accepted a lower offer to bring the right sharks into their company – Vineeta Singh and Aman Gupta. This week, 36 Indian startups raised funding of which 33 received a total of about $216 million. Wakefit was the top fundraiser which scooped up $40 million as a part of the Series D round. Last week, 16 homegrown startups raised funding worth about $273 million. Meanwhile, the funding details of the three startups remained undisclosed. Growth/late-stage deals This week, six growth or late-stage startups announced their new fundraise. The list includes Wakefit’s $40 million round along with LEAD, Park+, The Whole Truth, and CropIn among others. A clutch of these rounds kicked off in late 2022. Details of the 36 funding rounds can be found here. Early-stage deals In the early stage, 30 startups have raised funds including three undisclosed rounds. E-commerce startup VilCart was on top of the list with an $18 million Series A round. The list also includes edtech firm Toddle, Athulya, Qritrive, and Actyv.ai among others. Undisclosed deals Badhaan, Gytree, and Awaz did not disclose their financial details. City and segment-wise deals This week, Bengaluru-based startups dominated the funding chart. According to Fintrackr’s data, 25 Bengaluru-based startups have raised funds this week amounting to $174 million or 79.7% of the total funding. During the week, Pune, Mumbai and Delhi NCR saw two deals each. The complete breakdown of deals across cities and segments in the first half can be seen below: E-commerce (including D2C brands) and healthtech startups were the top segments in terms of the number of deals (eight deals each) as startups in these segments raised $77 million and $24 million respectively. SaaS, edtech, HR tech, and foodtech were next on the list. Acquisitions Besides fundraising, India’s startup ecosystem saw a couple of merger and acquisition deals. E-commerce (including D2C brands) and healthtech startups were the top segments in terms of the number of deals (eight deals each) as startups in these segments raised $77 million and $24 million respectively. SaaS, edtech, HR tech, and foodtech were next on the list. Acquisitions Besides fundraising, India’s startup ecosystem saw a couple of merger and acquisition deals. “Disclaimer:Bareback Media has recently raised funding from a group of investors. Some of the investors may directly or indirectly be involved in a competing business or might be associated with other companies we might write about. This shall, however, not influence our reporting or coverage in any manner whatsoever.