Omnichannel enablement startup Omnivio raises $1.02M led by Caret Capital, others Omnichannel enablement startup Omnivio has raised $1.02 million (Rs 8.4 crore) in a seed funding round led by Caret Capital, formerly known as Supply Chain Labs, with participation from Blume Ventures, Eximius VC, SuniconVenture Fund, and Misfits. Angel investors participation The round also saw participation from several angel syndicates and individual investors from India, the Middle East, and Southeast Asia. Other existing investors, including 91 Ventures, Dexter Angels, and Supermorpehus also joined the round, bringing the total funds raised by Omnivio to approximately Rs 12 crore ($1.5 million). Omnivio redefining the omnichannel experience Omnivio said it aims to redefine the Omnichannel experience for retailers and omni-brands by addressing one of the most significant challenges in the industry—ensuring seamless customer experiences across multiple channels. With the Omnivio control tower and orchestration platform, the startup offers post-checkout visibility and business operations control across marketplaces, own checkouts, and physical stores. How will it utilize the raised capital? With this new round of funding, Omnivio will focus on the development of its Omni-channel visibility and orchestration product suite. Additionally, the startup plans to expand its enterprise Go-To-Market (GTM) teams in India and the Middle East. On the investment in Omnivio, Prajakt Raut, Managing Partner from Caret Capital, said, “While omni-channel is rapidly becoming mainstream, companies find it challenging to transition from a pure offline player to an omni-channel player, or vice-versa, astheir existing supply chains and distribution networks are not designed for the omni-channel world. He further mentioned that the Omnivio Saas platform provides brands with a control tower for managing synchronization between different stakeholders and delivering gold-standard consumer experiences. source: https://indianstartupnews.com/news/omnichannel-enablement-startup-omnivio-raises-seed-funding-led-by-caret-capital-others-1560783

Invesco marks up Swiggy’s valuation to $8 Bn

Invesco marks up Swiggy’s valuation to $8 Bn While valuation mark-ups and mark-downs barely suggest any drastic changes for the companies involved, they do manage to stir a narrative among the general public about hyper-funded startups such as Swiggy. After facing valuation markdown by several investors, its stakeholder Invesco has marked up Swiggy’s valuation to $8 billion. It’s worth noting that Invesco valued Swiggy at $5.5 billion in May this year. Later, it increased the Bengaluru-based company’s valuation to $7.85 billion in July’s closure. Swiggy reached the peak value of $10.7 billion and entered the decacorn club after a $700 million round in January 2022. During CY22 (Jan-Dec 2022), the firm’s food delivery business GMV (gross merchandise value) grew 26% year-on-year, while the GMV of its quick-commerce business ‘Instamart’ reported a 459% annual growth, according to Prosus. In June, Prosus disclosed that Swiggy’s total revenue for the period saw a significant 40% jump to $900 million in CY2022 from around $640 million in the previous year. This further indicated that Swiggy incurred nearly $545.5 million loss during the January-December 2022 period. Prosus is the biggest stakeholder in the Bengaluru-based firm and holds 32.83% stake. Meanwhile, Swiggy’s CEO Harsha Majety claimed that the firm’s food delivery business turned profitable as of March (2023). However, looking at the company’s 2022 results, the profitability seems distant. The company is yet to file its FY23 financial results. While several unicorns faced valuation mark down in 2023, startups like Meesho, PineLabs and Swiggy have managed to up their valuation by their early backers. source: https://entrackr.com/2023/10/invesco-marks-up-swiggys-valuation-to-8-bn/

EV infra startup Bolt.Earth raises $20 Mn

EV infra startup Bolt.Earth raises $20 Mn EV infrastructure and software company Bolt.Earth has raised $20 million from Union Square Ventures, Prime Venture Partners and ITIGO Funds, among others. Union Square and Prime Venture Partners had already backed the Bengaluru-based startup during its Series A round of $4 million in September 2021. The company then rebranded itself from Revos to Bolt.Earth. The company said it will use the fresh capital infusion for charging network expansion, product enhancement, and operating system development and international expansion. Bolt.Earth offers charging solutions for individuals, businesses, real estate companies, fleet operators, and the government. The firm caters to a wide spectrum of charging needs, with options ranging from slow to fast charging, featuring power outputs from 3.3 kW to 240 kW. The company’s low-code integration platform helps OEMs and EV dealers to upgrade their vehicles. Bolt.Earth claims to have deployed more than 30,000 EV charging points within its charging network. The firm is now looking to ramp up its charging network and expand its business in Asia, Europe, South America, and Latin America. Bold.Earth remained in the pre-revenue stage during the fiscal ending March 2021. In FY22, the company recorded Rs 78.5 lakh revenue from operations along with a loss of Rs 22.35 crore. The company has not disclosed FY23 numbers yet. The fund inflow in electric vehicle startups picked up in the second half of 2023 after an initial drop down and this can be gauged from the funding trend when compared to the previous years. Data compiled by TheKredible shows that EV saw nearly 40 deals worth $631 million in funding during the first nine months of 2023 or till September this year. This is on par with previous years’ investments. In 2022 and 2021, the investments in EV-focused startups stood at $796 million and $570 million respectively. Source: https://entrackr.com/2023/10/ev-infra-startup-bolt-earth-raises-20-mn/

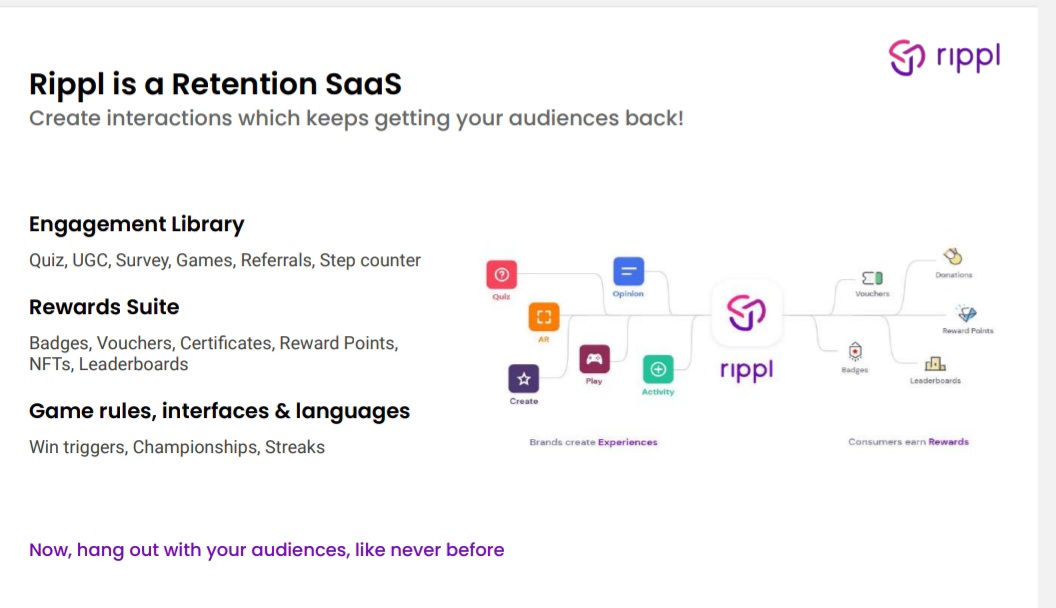

Try Using Gamification To Increase Customer Retention And Engagement.

Try Using Gamification To Increase Customer Retention And Engagement. Gamification is the process of incorporating game mechanics and elements into non-gaming contexts, such as a customer loyalty program or an e-commerce website. By doing so, it can help to improve customer engagement and retention in several ways: Increases motivation: Gamification provides customers with clear goals and incentives, such as rewards or achievements, which can motivate them to engage with a brand and continue using its products or services. Enhances customer experience: By making the experience of using a product or service more fun and enjoyable, gamification can increase customer satisfaction and loyalty. Provides immediate feedback: Gamification often provides immediate feedback on customer actions, such as completing a task or reaching a milestone, which can increase motivation and engagement. Builds community: Gamification can create a sense of community and encourage social interaction among customers, which can help to build loyalty and increase retention. Encourages repeat behavior: By rewarding customers for repeat behavior, such as making multiple purchases or referring friends, gamification can encourage customers to continue engaging with a brand over time.